The practice of asset managers refunding part of the management fees to the distributors (=sellers) of their investment products, the so-called inducements, has always been controversial. Despite recent regulatory tightening, inducements are still omnipresent among Belgian mutual funds. This article deals with the basics of inducements as well as the regulatory risks associated to this practice.

Understanding Inducements

When buying a mutual fund, one could wonder how banks make a living out of this. Of course, it is possible that a transaction fee is charged. Moreover, in case clients were advised to buy a particular fund, they are likely to pay a recurring advisory fee. However, these ‘visible’ fees are just a small part of the story. This is where inducements come into play.

To understand the concept of inducements, it is important to first understand the general revenue model of mutual funds. When investing in such a fund, you will pay the net asset value (NAV). This NAV is calculated on a frequent basis (usually daily). When the prices of the underlying securities in the fund will rise, the NAV will rise as well and vice versa. Nevertheless, it is not just a simple reflection of the fund portfolio, as also the fees to the asset managers are entailed in this NAV calculation. For the most common actively managed funds, these fees amount to 1 to 2% on a yearly basis.

A simple example can help clarifying the impact of these fees: suppose that today an investor buys one share of a fund that exclusively invests in the stocks of the ABCompany and charges 1.5% yearly management fee. For the sake of convenience, the applicable NAV of this fund happens to be exactly €1000. Moreover, assume that in exactly one year, the investor sells the share of the fund again, and the ABCompany stock price has stayed identical (while no dividends were distributed in the meantime). Now, given that the underlying portfolio did not move in value, one could argue that the NAV should have remained stable at €1000. Quod non. Because the fees of 1.5% represent a cash outflow from the fund to the asset manager, the sell price will only be €985! Hence, the investor has paid costs that were ‘hidden’ in the NAV calculation.

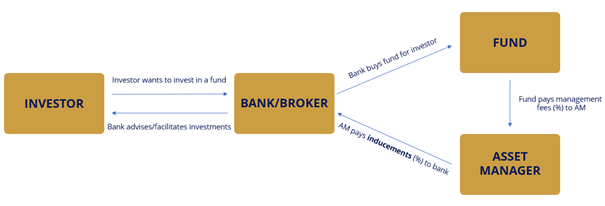

Extending the example hereabove, the fund’s asset manager charged €15 to the investor. Now, assume that this particular asset manager has an agreement to refund 50% of the fees earned to reward the bank for selling/promoting their funds. In this case, €7.5 will flow back from the asset manager to the bank. This €7.5 is called an inducement (or kickback, retrocession and sometimes distribution fee). A schematic representation of the situation just described could be the following:

Subsequently, the two main objections against inducements are not very hard to determine. Firstly, there is a lack of transparency towards the investor. Secondly, the bank/broker can be seduced to offer or advise funds with the most attractive agreement regarding inducements, thereby violating the interests of the client. It is not surprising that inducements have been the subject of numerous regulatory activities.

Lessons form the UK & The Netherlands

Nowadays, this regulatory pressure is mainly driven by European powers and more specifically by the European Securities and Markets Authority (ESMA). However, some national supervisors did not wait for European legislation and prohibited inducements nationwide for retail/private investors. Most notable examples are the UK & the Netherlands, both introducing a ban on inducements around 2013-2014.

The consequences of this ban have become clear. Among others, the most important results are the following:

- The total fees for investing in funds do not decrease. While the cost structure has changed, allowing banks to retain more fees directly (e.g., by raising current fees or by simply creating new, previously non-existent fees), the total cost for the end client did not significantly change. An evolution linked to this subject is the creation by asset managers of ‘clean’ funds/share classes specifically for countries with an inducement ban. In this context, ‘clean’ means that an already existing fund is duplicated without inducements, thereby complying with the national rules (of the UK and/or the Netherlands).

- Investors move away from advisory services towards discretionary management and execution only. This is logical as costs become more visible because of the ban, forcing clients to re-evaluate their investment decisions. Moreover, the relative impact of inducements is the highest in advisory formulas.

- Investors move away from active to passive management as well. The reason for this is obvious: the fees for active funds become more visible, so the perceived relative attractiveness of passive investments increases.

- Banks are increasingly promoting/offering their inhouse funds, advancing the vertical integration between banks and their asset management twins (think about XYZ Bank & XYZ Asset Management). The reason is that the change in cost structure resulting from the inducements ban is easier to apply within the same group (i.e., to ensure that the same level of fees/profits is earned on XYZ Group level). On the other hand, when banks are cooperating with external asset managers, it will provoke more complexities to adjust the fee structure while trying to keep all parties happy.

Supervisory authorities are praising the encouragement for distribution of more cost-effective investment products and the rise of independent financial advice, while increasing competition between product manufacturers to the benefit of consumers. Nevertheless, critics of the inducement prohibition concluded the opposite. According to them, quality independent advice has become scarcer, while product driven sales are rising.

Quid ESMA? In 2018, inducements were banned across the EU for discretionary management and independent financial advice for retail investors as part of MiFID II. Moreover, regulations were approved to increase transparency on inducements. The most important change in this domain is that banks and brokers must now clearly indicate the total amount of inducements paid by the end client. Thus, the ESMA decided not to follow the example of a complete ban in the UK & the Netherlands. They asked the European Commission instead to conduct further analysis on this matter, asking them to investigate the intended consequences as well as the potential unintended consequences of a complete ban. To be continued.

Finally, it is worth mentioning that inducements also play a role for investment-based insurance products. Despite being the subject of recent regulatory scrutiny as well (by IDD, the MiFID twin for insurance), inducements are currently not banned for any formula.

The Belgian situation

Hence, the European partial ban on inducements also influenced the Belgian fund landscape as from 2018. For advisory services, it did not change much as almost no player with a bit of scale qualifies for independent financial advice. On the other hand, the impact on discretionary management was significant and caused many industry players to re-evaluate their offer within this segment to comply with the new regulations (e.g., creation of clean share classes in Belgium).

When predicting the potential consequences of a complete ban on the Belgian market, one could argue that the shock might be large: the percentage of inducements as compared to total management fees can be up to 70%! Considering the current landscape, the impact might be harder to mitigate for smaller (online) players.

Most of the larger banks in Belgium have very close ties with one or more preferred asset management partner(s) (recall the example of XYZ Bank & XYZ AM). In case of a complete inducement ban, there is no doubt that these parties will be able to reshuffle their joint cost structure to ensure that the total income will remain on the same level.

On the other hand, an inducement ban could be a genuine hold-up on the busi

ness model of some smaller online players. It is no secret that some of them are making a substantial part of their living out of inducements. Hence, a ban would force them to re-evaluate their entire earnings model. There is little doubt that these particular players will follow the regulatory developments on inducements closely. To be continued?

Source: https://www.finance-watch.org/uf/cartoon-on-inducements/